Dec. 12, 2025

As some Cheetos lose their old orange, will PepsiCo be stained?

Share this story

Earlier this year, food companies began phasing out artificial dyes and sweeteners from their products at the behest of the Food and Drug Administration. Manufacturers of chocolates, cereals and soda have agreed to introduce synthetic-free lines of some of their most iconic brands.

You may not notice the difference in some of these products, but others — such as PepsiCo’s iconic Cheetos and Doritos — will have a noticeably different look. The “naked” version of these, which the company plans to sell under the Simply NKD label alongside the originals, will lack the telltale orange dust that left “Cheeto-fingers” in its wake.

Will customers be turned off by the alternate version? Or, as the country shifts to a more health-conscious mentality, will they embrace it?

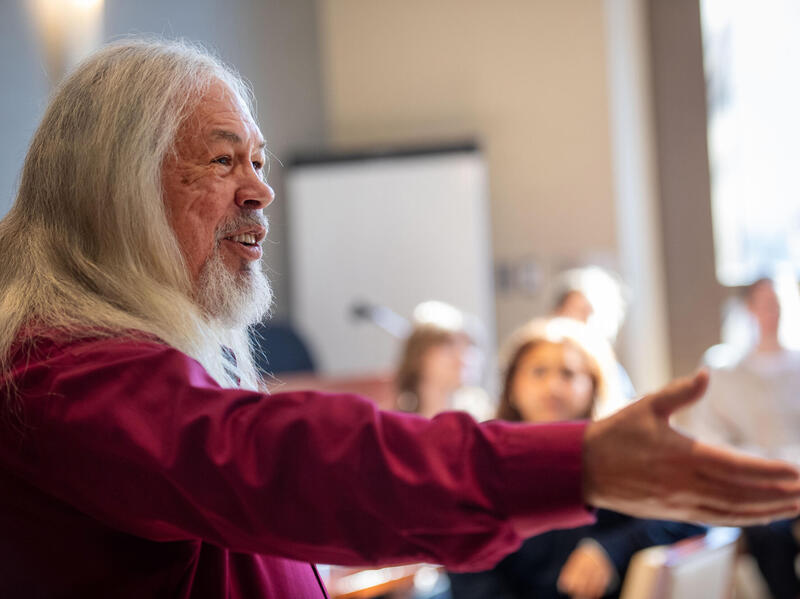

For insight into the risk and reward that PepsiCo faces, VCU News caught up with Vann Graves, Ed.D., executive director of Virginia Commonwealth University’s Brandcenter, whose acclaimed graduate programs have propelled leaders in the advertising and branding industry.

So, the “naked” Cheetos and the originals will be available. What if they look different but taste the same?

If that proves true, the move raises a harder question: Why were the dyes there in the first place? By offering a colorless alternative, PepsiCo is indirectly acknowledging that some consumers had valid concerns about additives. That tension will follow the brand as the line rolls out.

And the visual component is a big risk, too, right?

The orange residue on your fingers is a signature part of the Cheetos experience. That sensory moment has shaped the brand for decades. Removing that visual cue is a serious risk. It interrupts a ritual that many consumers associate with fun and nostalgia.

PepsiCo is trying to manage the risk by keeping the original products exactly as they are. The Simply NKD versions sit alongside the classics rather than replacing them. The company presents this as an expansion of choice instead of a shift in identity.

This expansion happened pretty quickly.

Consumer behavior is shifting. More shoppers say they are cutting back on impulse snacks and paying closer attention to ingredient lists. PepsiCo is responding with speed and urgency. The company developed the Simply NKD line in only eight weeks. That pace tells you they see possible business risk, not just a marketing opportunity.

What other factors are driving the company to act with urgency?

PepsiCo is moving fast because several forces are pressuring the snack category at the same time. GLP-1 weight management drugs are reshaping eating habits and reducing demand for salty snacks. This is not a passing trend. It is a shift in how many Americans approach appetite and portion size.

At the same time, federal regulators are signaling tighter rules on synthetic food dyes. PepsiCo has a large portfolio of products that still rely on those ingredients, so getting ahead of regulation protects the business from future disruption.

Give us an insider’s sense of the marketing campaign, including who the audience is.

PepsiCo is trying to reshape the conversation around indulgent snacking without losing the emotional pull of its most recognizable brands. This clean positioning signals fewer artificial additives, which speaks to Millennials, Gen Z and parents who want familiar flavors without long ingredient lists.

It also reflects a broader shift in how shoppers evaluate snack foods. Many will still indulge, but they want to feel better about what they choose.

The company is trying to maintain the bold, flavorful personality that defines Doritos and Cheetos while avoiding the health food category. By focusing on removing dyes rather than a full nutritional overhaul, PepsiCo hopes to expand its appeal without signaling a complete identity shift.

Isn’t this a challenging fine line for the company to walk?

Some people will feel uneasy. Loyal fans who see the orange dust as part of the Cheetos ritual may feel something important has been taken away. Others will question whether this is genuine progress or a cosmetic change. If calories, sodium and fat levels remain similar to the originals, the company will face criticism for dressing up the same product in a cleaner costume.

This is where visual marketing will be closely watched. Influencers like Matt Roseman on Instagram highlight how packaging can make a product appear healthier without meaningful nutritional changes. His work underlines how strongly consumers respond to design cues, sometimes more than the facts on the label. This dynamic will shape how Simply NKD is received.

At the same time, there is a clear audience ready for this. Parents, health-aware shoppers and consumers influenced by wellness culture will recognize the shift in ingredients as a positive step. PepsiCo is trying to give them a version that feels safer without alienating classic fans.

With a new corporate identity and this launch happening at the same time, is PepsiCo doing too much?

PepsiCo is trying to create momentum across the entire organization. The new brand identity highlights health, sustainability and scale, and the Simply NKD launch supports that direction. The company has struggled with brand recognition across its broad portfolio. A coordinated refresh helps bring attention to the range of food and beverage brands under its umbrella.

There is still a risk in moving this fast. Changing packaging, color cues and formulation all at once introduces many points where execution can falter. Consumers have long memories when a familiar favorite changes even slightly. Years of product failures across the industry show how fragile trust can be when iconic foods shift in look or taste. PepsiCo is betting that clarity of purpose and clear communication will keep the transition under control. Many of us remember Crystal Pepsi.

What else should we pay attention to?

The most important test will be on the back of the bag. The ingredient list and nutrition panel will shape how consumers judge the sincerity of this shift. If the only meaningful change is the removal of artificial colors and flavors, shoppers will see through the move quickly. Transparency matters more than the color of the product.

Price is another telling signal. By keeping Simply NKD at the same cost as the original products, PepsiCo is saying this is a straightforward ingredient improvement instead of a premium wellness pitch. That choice helps the new versions feel accessible rather than niche.

Is there a good timeframe for evaluation?

The next six months will show whether this was a smart, strategic, bold move or a hot mess. Success depends on whether consumers feel they are getting the same bold taste without the additives and without any sense of compromise. The company is promising both familiarity and progress. The market will decide whether that promise holds up.

Subscribe to VCU News

Subscribe to VCU News at newsletter.vcu.edu and receive a selection of stories, videos, photos, news clips and event listings in your inbox.