May 25, 2022

Feeling the effects of higher interest rates? Expect all borrowing to get more expensive

Share this story

The interest rate. It affects everything from the housing market and commercial real estate to employment and student loans. With inflation at a 40-year high, the Federal Reserve has raised interest rates in an effort to hamper the growth of business and consumer spending, which, in turn, could counter soaring inflation rates.

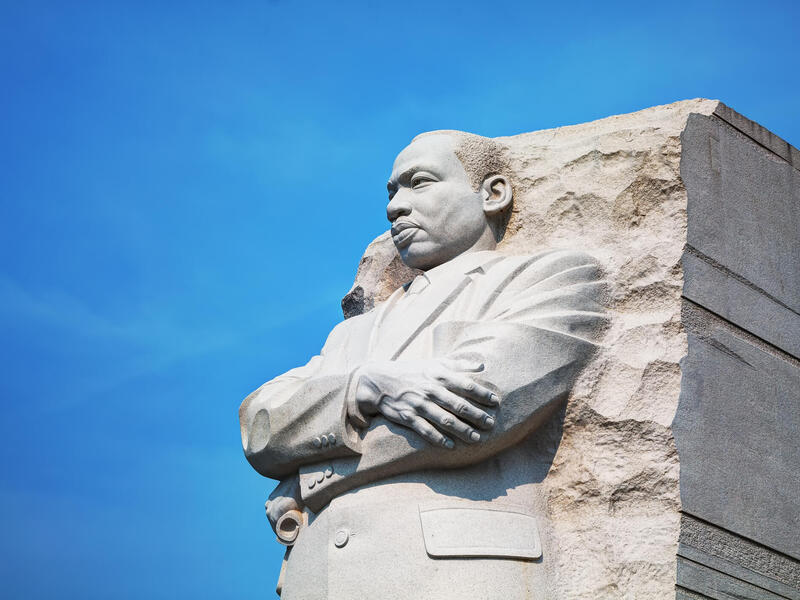

“The reduced demand for goods and services in the economy should ease some of the pressures that have been driving inflation higher in recent months,” said Christopher M. Herrington, Ph.D., an associate professor of economics in the Virginia Commonwealth University School of Business.

But will it be enough? What can consumers expect? Herrington discussed the interest rate/inflation balancing act with VCU News.

How do interest rates affect inflation? Why is the Fed raising rates to combat inflation?

In general, the Federal Reserve utilizes interest rate policy to achieve its two main objectives — known as the "dual mandate" — which are maximum employment and price stability. Currently, employment looks relatively strong, but inflation is significantly higher than the Fed's long-run target of 2%. In order to bring inflation back down, the Fed is raising the federal funds interest rate as it transitions from expansionary monetary policy — which was used to encourage economic activity for the last several years — toward more contractionary monetary policy. Higher interest rates will raise borrowing costs for consumers and businesses, which will lead consumers to reduce spending on things like homes, cars, furniture and appliances. Similarly, businesses will reduce their investment in new capital goods, like buildings, equipment, computers and the like. The reduced demand for goods and services in the economy should ease some of the pressures that have been driving inflation higher in recent months.

Is there a danger of interest rates becoming too high?

The Federal Reserve is certainly cautious about raising interest rates too much or too quickly as it balances competing risks. On the one hand, the Fed wants to raise interest rates enough to tamp down inflation and restore price stability, but on the other hand, the Fed does not want to curtail consumption and investment demand so much that the economy falls into a recession. This balancing act is at the heart of the dual mandate, and it is one that the Fed weighs very carefully. Of course, there are differences of opinion within the Federal Open Market Committee (FOMC) about the appropriate pace for tightening monetary policy (i.e., raising interest rates), but I expect we will continue to see interest rate increases at a steady pace for at least the next several FOMC meetings. Ultimately, though, the Fed is “data-driven,” meaning that it will respond to what it sees in the data. As Chairman Jerome Powell noted recently, the FOMC is prepared to continue raising interest rates until they see clear evidence that inflation is subsiding. He also indicated that the FOMC was prepared to act more aggressively if necessary or to slow the pace of interest rate increases if inflation moves back down toward the target more quickly.

How are consumers affected by the rise in interest rates? What do we need to know?

Many of the interest rates that consumers pay — for example on mortgages, auto loans, and student loans — are tightly linked to the Federal Reserve's interest rate policy. As the Fed has been raising rates recently, I'm sure many consumers are already feeling the effects of these higher rates. Just this year we have already seen average 30-year mortgage rates increase by about 2 percentage points, and the interest rates on federal student loans are also set to increase on July 1. In short, we can expect that essentially all forms of borrowing are going to get more expensive, and as I mentioned before, this should dampen somewhat the demand for consumer goods. On the flip side, however, consumers who have assets in saving accounts, money market accounts, CDs, or treasury securities may benefit from higher interest rates as the returns on those investments increase. It is really important to keep in mind that consumers are very heterogeneous, and so the effects of higher interest rates will be felt very differently by different people.

Subscribe to VCU News

Subscribe to VCU News at newsletter.vcu.edu and receive a selection of stories, videos, photos, news clips and event listings in your inbox.